"AMFI-Registered Mutual Fund Distributor"

General Insurance

Health Insurance

Protect your greatest asset – Health

Health insurance plans offer to cover or reimburse the cost of medical care in case you fall sick. These plans are vital to combat the ever increasing cost of healthcare in India. There are many types of health insurance but the two main ones are individual and family health insurance.

Motor Insurance

Protect your greatest asset – Health

Protection from a financial loss arising out of loss or damage to your vehicle.

Protection from liability towards third parties for personal injury.

Protection death and property damage on account of any accident involving

your vehicle.

Cash Less and Hassle free Claim procedure.

Travel Insurance

International travel is exciting. You get to see enchanting landscapes, experience new culture, taste delectable cuisine and explore uncharted territories. However, international travel is an expensive affair. That is why very few individuals manage to undertake an international vacation. Even when you manage to plan an international trip, any unforeseen contingency would strain your budget.

Critical Illness Insurance

Critical illness refers to life-threatening and severe health conditions, requiring extensive medical attention. Generally, treatment for such diseases requires prolonged medical care, whether in the hospital or at home.Therefore, the expense involved with treatment for critical illnesses are generally higher when compared to the treatment for other diseases.

Personal Accident Insurance

An accident can happen at any time. And it could leave you with permanent harm or temporary disability, both of which could affect your life and your family.

Apart from cover for life and injury, insurance offers other unique

and unmatched features

Weekly benefit

Medical Reimbursement

Education Benefit

Modification of residential accommodation and own vehicle

Ambulance hiring charges

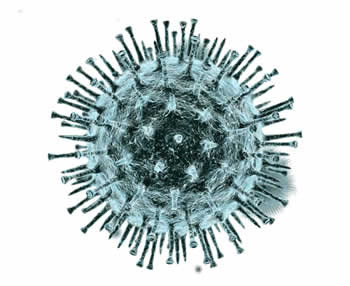

Corona Kavach

As we can see that the COVID-19 cases are increasing day by day. So, IRDAI has come with certain norms that the insurance companies must indemnify for the risks related to COVID-19 disease. The name of the policy must be Corona Kavach Policy in which the insurance companies will cover all the risks that arise due to the Corona virus disease.Fire and Marine Insurance

Fire insurance policy is suitable for the owner of property, one who holds property in trust or in commission; individuals/financial institutions who have financial interest in the property. All immovable and movable property located at a particular premises such as buildings, plant and machinery, furniture, fixtures, fittings and other contents, stocks and stock in process along with goods held in trust or in commission including stocks at suppliers/ customer’s premises, machinery temporarily removed from the premises for repairs can be insured.